Take your mortgage with you when you move | Mortgages | YBS

Moving with your mortgage

Maybe it’s time to move to a better mortgage

Early Repayment Charges and other fees and charges may apply.

Buying a new home with us

We love having you as a member and things don't have to change just because you're taking that exciting next step and moving to a new place. When you pack up for your new address, you may be able to move your current interest rate deal as well.

The process of moving your existing mortgage deal to a new home is known as 'porting' or 'portability' and works in a few different ways depending on the purchase price of your new home and your current mortgage. You can find out more about your portability options below.

What would you like to do?

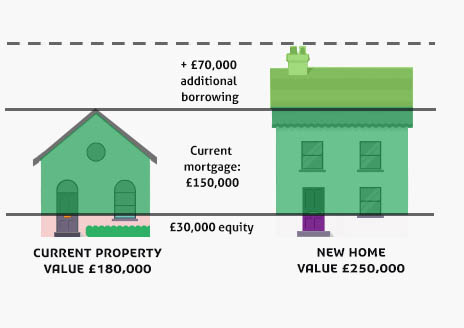

I'd like to borrow some more

If you find a new home that you would like to move to but you’re still within your current mortgage deal, you might be able to take your current mortgage deal with you. If this doesn’t cover the full amount needed, don’t worry, you can apply to top up the difference.

In this example the difference is £70,000. You would need to put in a deposit (or use the equity in your property) and then 'top up' to cover the rest with a new mortgage part e.g.

Your new mortgage: £220,000

(£150,000 borrowing on your current mortgage deal plus an extra £70,000 borrowing on a new mortgage part, using £30,000 equity towards the purchase).

In certain circumstances, you may choose to contribute less of your equity towards the purchase of your new home, however, this would mean that your Loan to Value (LTV) would be higher and may affect your eligibility for certain mortgage deals.

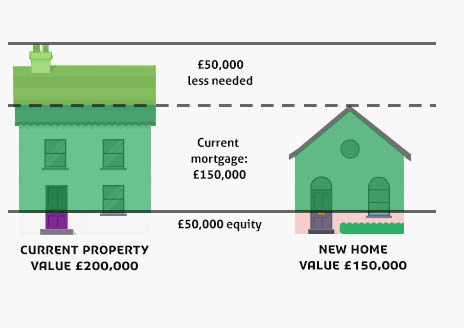

I need to borrow a bit less

If you are looking to downsize your property but you’re still within your current mortgage deal and you decide to borrow less, you may be able to reduce your mortgage deal and port it to your new property.

How much you sell your current home for will determine how much you need to reduce your mortgage by and how much you have available to contribute to the purchase of the new home.

In this example the difference is £50,000. You would have to reduce your mortgage amount to move it to the new property. e.g.

Your new mortgage: £100,000

(£150,000 current mortgage balance minus £50,000 no longer needed, using £50,000 equity).

I want to find out what I could do in my particular circumstances

If you want to find out what you can do with regards to porting your mortgage, try our portability calculator:

I need to change my mortgage due to a change in circumstances

If you need to change your mortgage due to a separation or bereavement, you can find out how this works on our Transfer of Equity information page.

How does it work?

- Check your original mortgage offer (or your most recent offer if you have already switched mortgages with us) for details on your eligibility to transfer your mortgage deal.

- Work out what you need to do from the options above.

- Make sure you have read our lending criteria before contacting us about applying.

When you are ready to apply, you need to get in touch with us to proceed. Call us on:

Things to be aware of...

- Before you start looking at options you should know that you will need to pay off your existing mortgage as part of transferring your current deal to a new property.

- As part of transferring (or ‘porting’) your mortgage deal to a new property, you can borrow the same amount or less but this must be on the same terms as your current mortgage deal.

- You and your property will need to satisfy the current lending criteria.

- You'll also need to complete on your new mortgage within six months of paying off your existing mortgage, pay any relevant fees (eg. valuation fees) and move to a property in England, Wales, Scotland or Northern Ireland.

Fees & charges for porting your mortgage

Depending on the terms of your existing mortgage deal, you may need to pay an Early Repayment Charge when moving your mortgage deal to a new property. However we will refund some or all of this charge when the new mortgage completes. ERC's work slightly differently depending on your circumstances:

- If you are borrowing more:

If you sell your current home and complete on your new property within 6 months you will then pay an Early Repayment Charge on redemption of your current mortgage (redemption is the repayment in full of your current mortgage) but you will then receive a full refund of this charge upon completion.

If you do not port your mortgage deal to the new property within the 6 month period then you would not be entitled to any refund. - If you are moving to a new home but without any additional borrowing:

As above, if you port your mortgage deal to a new property within 6 month you would initially pay an ERC but then be refunded on completion. There wouldn't be a refund if the porting of your mortgage deal is outside the 6 month period. - If you are downsizing:

If you sell your current home and complete on your new property within 6 months you will then be entitled to a refund of any ERCs paid on a 'pro-rata' basis.

For example, if your current mortgage is for £100,000 and you downsize to a home worth £90,000, you would receive a refund of 90% of any charge paid but not on the 10% difference.

Call us or book an appointment

Speak to one of our friendly advisers about your options.