Your Society | YBS

Your Society

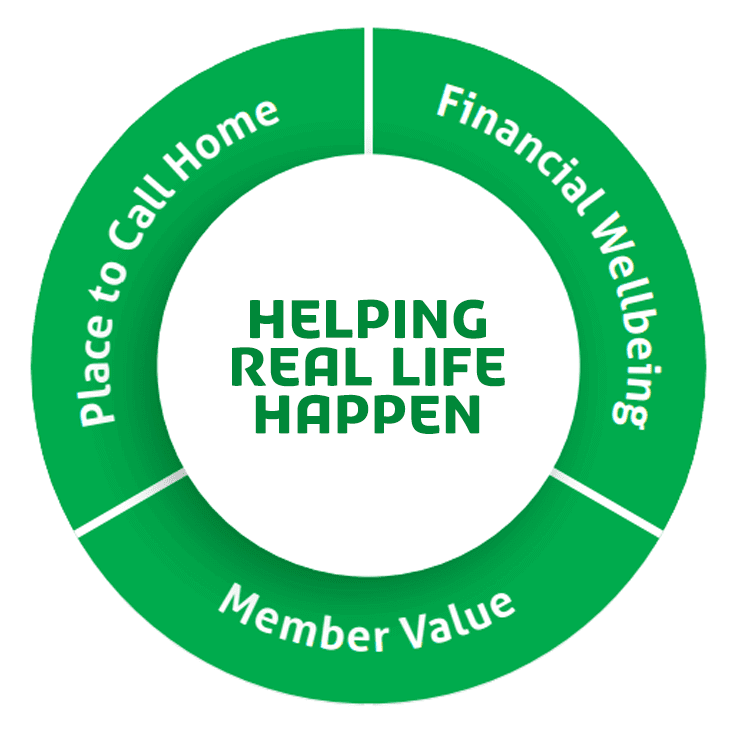

We’re here to help you achieve your key life moments, we call it Helping Real Life Happen.

Everything we do is designed to help us deliver on our purpose.

Our Purpose Priorities

Our purpose is Helping Real Life Happen. As a building society, this means delivering three central ambitions:

- Helping people to have a place to call home

- Helping them towards greater financial wellbeing

- Creating long-term value for our members

A place to call home

We're here to help people have a place to call home. This includes supporting first time buyers and house movers through a range of residential mortgages.

We've also supported people through social housing and our previous partnership with End Youth Homelessness.

Financial wellbeing

We want to help everyone improve their financial wellbeing, including:

- People choosing to build up their savings

- People who have taken part in our financial literacy initiatives and employability skills sessions across our local communities

- Support for our charity partner FareShare until June 2026, and collaborating with Citizens Advice

- Supported Age UK until 2023

Member value

As a building society we’re run differently from a bank. We don’t have external shareholders to satisfy, instead we’re here for the benefit of you, our members. The money we earn is given back to you in interest rates or goes towards paying for the service we provide or gets re-invested to build a stronger society for the future.

Hear from our members about the benefits of being part of our society.

Our Responsible Business Priorities

We also have three additional priorities that, together with our purpose priorities, make our ESG strategy, these are:

- Investing in our people

- Building a greener society

- Operating responsibly

Investing in our people

Our ambition is to be a leading employer and unleash the potential of every colleague.

That’s why we champion a culture of supporting all colleagues, prioritising their wellbeing and promoting diversity. From being a signatory to the Women in Finance Charter, to our commitment in building a more balanced workforce.

Building a greener society

At YBS our vision to build a greener society means that high environmental standards will be integrated into all relevant business operations.

We will achieve a net zero transition that is fair for all our customers and helps them to find a place to call home.

Operating responsibly

As a mutual, being a responsible business is key to everything we do.

Having the right governance and procedures in place allows us to meet regulatory requirements, and protects customers, colleagues and YBS from potential risks.

What else are we doing as a responsible business?

- We give back to our communities through our volunteering programme

- We support charities through the Yorkshire Building Society Charitable Foundation