Payments into your account

Information on receiving payments into your YBS account

Receiving a payment

You can pay into your account by CHAPs, Faster Payments or Standing Order.

If you’re registered for online services, you can also pay in by debit card. You can do this by logging in, selecting the account you wish to pay in to and following the onscreen instructions. If your account doesn’t give you an option to deposit money this could be due to the terms and conditions of the account. You'll start earning interest on your deposit 2 working days after it clears.

You can only make deposits from within the UK.

Information you'll need

| Account name | Yorkshire Building Society account holder's name |

|---|---|

| Sort code | 60 – 92 – 04 (operated through one of our main bankers – NatWest Bank Plc) |

| Bank Account Number | The first 8 digits of your YBS account number |

| Reference or Roll number | The full 10 digits of your YBS account number (not required for direct debits) |

Payment timescales

Faster payments

Faster Payments usually take 2 hours to reach your account.

CHAPs

CHAPs payments are guaranteed to arrive in your account on the same day they’re made. However, payments must be made before 12pm (midday) Monday to Friday (excluding bank holidays). Payments made after this will be received the next working day.

Standing Orders

Standing Orders are normally processed and cleared on the same day they're sent. However, you should allow 3-5 days for Standing Order payments to be cleared in your account.

Debit card

When you use your debit card to make a deposit, it will normally take 3-5 days for the funds to clear. You may see the amount credited to your account more quickly than this, however you won't start earning interest until the funds have cleared.

Payment delays

Payments containing incorrect or missing information may take longer to process or may be returned to the sender if we cannot prove that they belong to you. Always check that the correct information is entered when sending a payment or when asking someone else to send a payment to your account.

Cheques

You can pay a cheque into your YBS account at any branch or agency. Cheques should be made payable to the account holder and not to the Society.

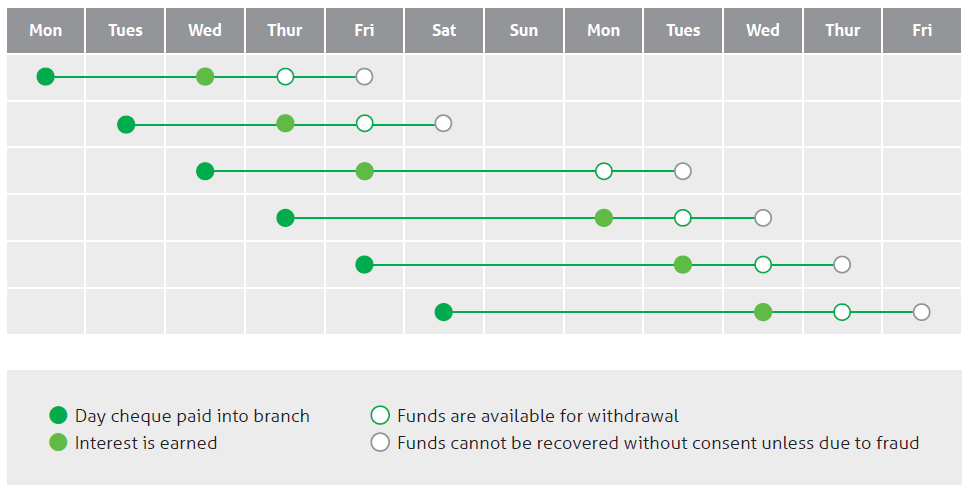

Yorkshire Building Society savings accounts use the YBS clearing cycle timeline, as explained below.

Timeline for a cheque paid into your account on Monday

| Monday | The cheque is paid into the account | |

|---|---|---|

| Tuesday | Working day 1 | The cycle starts on the first working day after the cheque is paid into your account. A working day is any day excluding a Saturday, Sunday or bank holiday in England and Wales. If a Saturday, the cycle will start on the next working day. |

| Wednesday | Working day 2 | Interest starts to be earned today. |

| Thursday | Working day 3 | You will be able to withdraw the money today. However the cheque could still be returned unpaid (bounced) until the end of working day 4. |

| Friday | Working day 4 | You can be sure the money is yours at the end of today. The money cannot be reclaimed without your consent (unless you are a knowing party to fraud). |

Need more help?

Lines are open:

9am to 5pm Monday to Friday

9am to 1pm Saturday

9am to 5pm Monday to Friday

9am to 1pm Saturday

Lost or stolen card

Lines are open 24 hours a day, 7 days a week

You can, also, report a lost or stolen card in branch or online.