How to buy your first home

You’re buying your first home! It's probably the biggest and most exciting purchase you'll ever make.

Your home may be repossessed if you do not keep up repayments on your mortgage.

What do you want to know?

First time buyer exclusives

Mortgages

The £5k Deposit Mortgage

Available exclusively to first time buyers

Minimum deposit: £5,000

Maximum property value: £500,000

Not available for new build flats or houses

Early Repayment Charges apply. Other fees and charges may apply.

Savings & ISAs

First Home eSaver

Available exclusively to first time buyers

Open from £1.

Save up to £500 per month for 2 years

Interest paid annually

One withdrawal day per year, based on the anniversary of account opening, plus closure.

Getting ready to apply

Boost your chances of getting a mortgage

What are the costs when you apply for a mortgage?

Getting mortgage ready

Find out how much you can borrow

Just a handful of questions and you can find out how much we might lend to you.

Takes about 2 minutes to complete.

Takes about 2 minutes to complete.

Compare mortgage deals

We have a range of mortgage types available with terms from 5 to 40 years.

Get a Decision in Principle (DIP)

A DIP is a quick check of your finances to find out if we can lend to you, and how much you could borrow.

Takes as little as 10 minutes

Won't affect your credit rating

Lasts for 90 days.

Mortgages explained

What is a mortgage?

A mortgage is a type of loan designed to help you buy property or land.

How does a mortgage work?

If you want to buy property or a piece of land, you might decide to approach a mortgage lender and ask to borrow the money.

The lender will assess your financial history and decide whether they are willing to loan the money to you and how much they will charge you for the mortgage.

When you apply for a mortgage, you usually need to put down a percentage of the cost of the property you want to buy. This is called a deposit.

The rest of the cost to buy the property is what you borrow and that is the mortgage loan.

You will sign a mortgage contract with your lender that agrees the terms of your mortgage loan such as,

The lender will assess your financial history and decide whether they are willing to loan the money to you and how much they will charge you for the mortgage.

When you apply for a mortgage, you usually need to put down a percentage of the cost of the property you want to buy. This is called a deposit.

The rest of the cost to buy the property is what you borrow and that is the mortgage loan.

You will sign a mortgage contract with your lender that agrees the terms of your mortgage loan such as,

how much you will pay back per month

the interest rate you will pay

the mortgage term or how many years you’ll have to pay the money back to the lender.

What does it mean when people say, "getting on the property ladder"?

A “property ladder” is a metaphor for the different steps you might take in owning property. From your first step buying your first home, to selling your first house to buy your next home, on your next step on your property ladder.

There could be many steps over a lifetime but there are no rules. Some people will only ever buy one or two homes in their lifetime.

There could be many steps over a lifetime but there are no rules. Some people will only ever buy one or two homes in their lifetime.

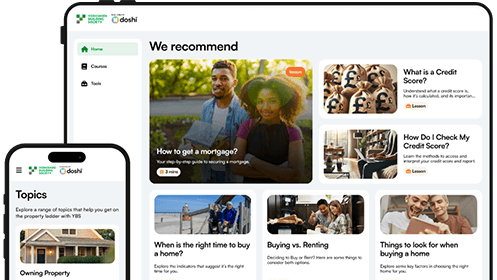

Learn about finance the interactive way

Master your finances with interactive lessons

We’ve teamed up with Doshi to boost your money confidence.

Mortgage guides

Mortgage guides

What is a Decision in Principle?

Getting a Decision in Principle is often one of the first steps to getting a mortgage. Find out what it is, why it can be useful and how to apply for one here.

Mortgage guides

How to get onto the property ladder

Buying your own home is a goal for many people. But what are the best ways to get on the ladder? Start your mortgage journey here.

Mortgage guides

How to save for a mortgage

Saving for a deposit on a house is easier said than done, but we’ve put together some tips to help you reduce spending and save up.