What is a new build mortgage?

A new build mortgage is a residential mortgage on a new build home.

A house or leasehold flat is classed as a “new build” if it’s been built, converted or refurbished in the past two years.

A house or leasehold flat is classed as a “new build” if it’s been built, converted or refurbished in the past two years.

How to get a new build mortgage

Get a Decision in Principle (DIP)

Get a Decision in Principle (DIP) to find out how much you could borrow. Choose how to get a DIP below.

You may need a DIP to make an offer on a home.

You may need a DIP to make an offer on a home.

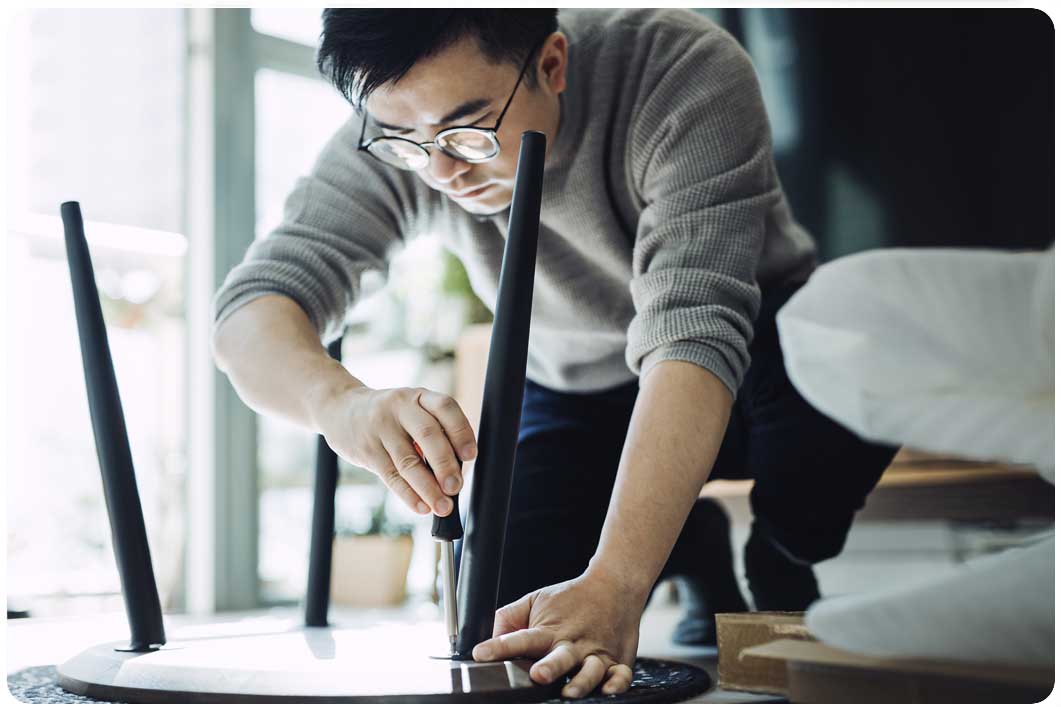

Find and secure your home

When you find a home you will need to pay a deposit to the developer.

You’ll get a reservation agreement. This tells you how long you have to get a mortgage.

You’ll get a reservation agreement. This tells you how long you have to get a mortgage.

Apply and get a mortgage offer

You can apply for a mortgage once you have a reservation agreement.

We’ll value your home and check your credit history. Then we’ll be in touch within 15 working days.

We’ll value your home and check your credit history. Then we’ll be in touch within 15 working days.

Complete

Once the legal work is complete, you'll exchange contracts and set a completion date.

This is when you'll get the keys to your new home.

This is when you'll get the keys to your new home.

Get a Decision in Principle

Apply online

Instant decision

Valid for 90 days

Doesn't affect your credit score

Find out if you can apply online and start our 10 minute application.

Speak to an expert

Talk to our mortgage specialists.

Calls to 03 numbers are charged at the same rate as 01 or 02 numbers from all phones.

What deposit do I need for a new build?

Your mortgage deposit needs to be at least 5% of the property value (10% for leasehold flats).

For example:

For example:

If the home you want to buy is £200,000, you'll need a deposit of at least £10,000. You would need a deposit of at least £20,000 for a flat of the same value.

Reservation fees

You may also need to pay the developer a deposit to secure your home before

applying for a mortgage with us.

This is often called a reservation fee. How much this costs and when you pay it depends on the developer. The cost of the reservation fee may be taken off the overall price of the home.

Is a new build mortgage right for me?

You want to buy a new build property.

You have at least a 5% deposit (10% for leasehold flats).

You want to borrow up to £1 million.

You meet our lending criteria.

Things to consider with a new build mortgage

You need to check we accept the new build warranty on the home you want to buy.

As with all mortgages, early repayment charges and other fees and charges may apply.

What is a new build warranty?

A new build warranty is an insurance policy taken out by the builder or developer. It protects you in case there are defects in your property.

Each warranty is different, so it is important to check what’s covered.

Before you apply for a new build mortgage with YBS, check that we can accept your new build warranty.

Each warranty is different, so it is important to check what’s covered.

Before you apply for a new build mortgage with YBS, check that we can accept your new build warranty.

Acceptable new build warranties are:

- National House Building Council (NHBC)

- Premier Guarantee

- Local Authority Building Control (LABC)

- Building Life Plans (BLP). These policies are underwritten by Allianz Global but written by BLP

- Build-Zone

- Checkmate / Castle 10 (nb. where out buildings such as a detached garage are also being constructed an endorsement to include these in cover is required)

- Build Assure (New Home Structural Defects Insurance)

- Global Home Warranties (Structural Defects Insurance)

- The Q Policy for Residential Properties

- The Q Policy for Bespoke Properties (detached only)

- Protek

- Advantage - There must be no more than 10 units in any continuous structure

- International Construction Warranties (ICW)

- Ark Residential New Build Latent Defects Insurance. Where a detached garage/outbuilding has been constructed at the same time as the main building, the policy must include an endorsement confirming cover for the detached garage/outbuilding

- Aedis (nb. There must be no more than 20 units in the structure)

- One Guarantee

- CRL new build 10-year structural defects insurance policy for residential property on new properties, where the insurer is International General Insurance Company (UK) Ltd and Ark have signed the final certificate. Please see the final paragraph on the final certificate. This will confirm Ark details and that they are signing on behalf of the insurers.

Warranties we do not accept:

- New build properties underwritten by Alpha

- Second hand properties being sold by first or subsequent owner and property is under two years old. Warranty underwritten by Alpha.

Call us

Chat to our mortgage specialists about your options.

Calls to 03 numbers are charged at the same rate as 01 or 02 numbers from all phones.

Book an appointment

Book an appointment and we'll call you back.