Savings Rate Calculator | Savings | YBS

Savings rate calculator

We now apply tiered interest rates to some of our variable rate savings accounts. This means we can increase rates on lower balances, helping more members.

We calculate the balance and interest rate based on these assumptions:

That you will not take any money out during this 12 month period.

That there will be no changes to the current interest rate.

That you will leave all the interest earned in the account.

That if your savings deal has a fixed rate term of over 12 months, you’ll leave the interest that is added at the end in the account.

How tiered interest works

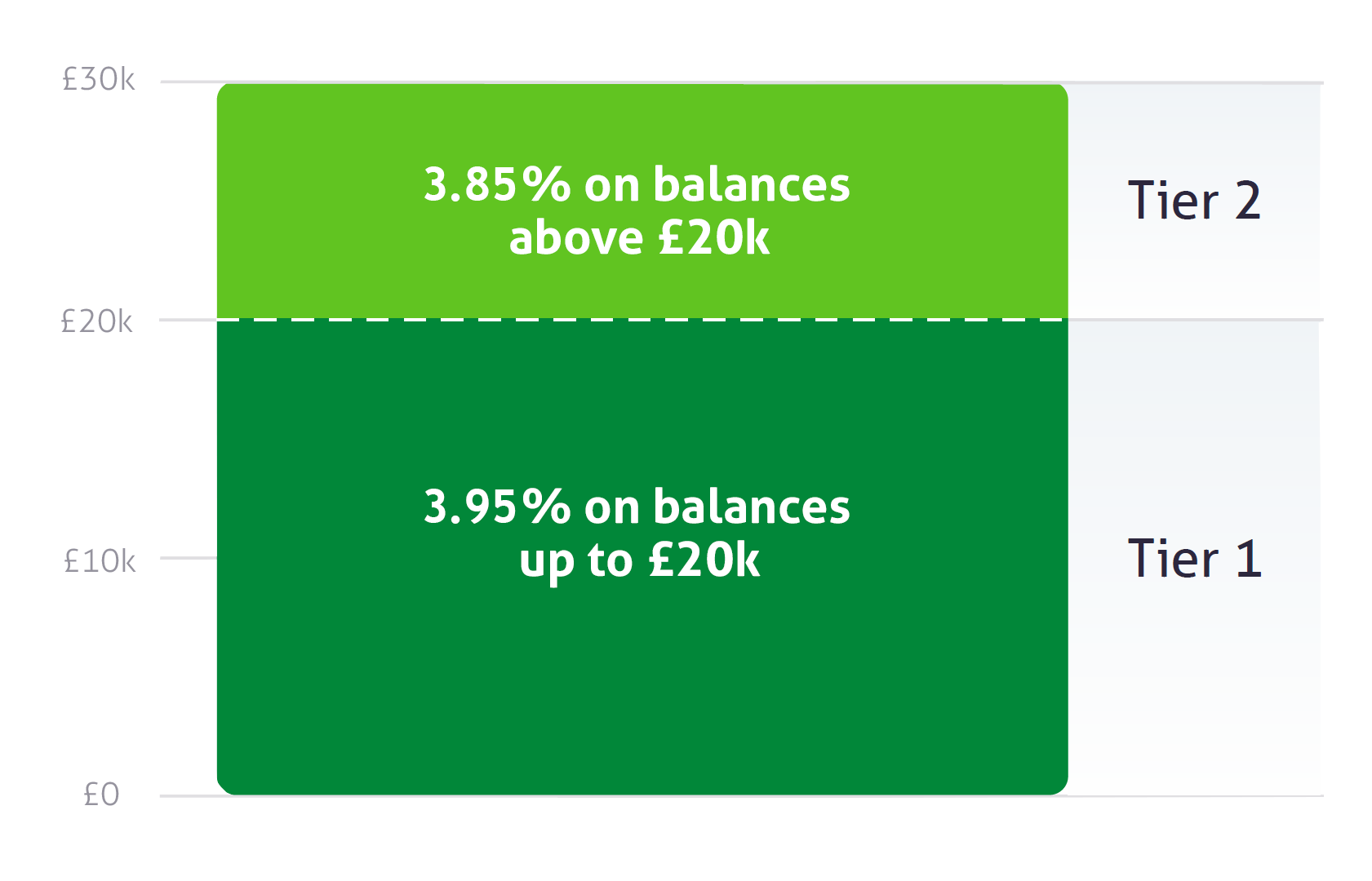

Products with two interest rate tiers

| Balance up to £20,000 | £20,000.01 and above |

|---|---|

| 3.95% | 3.85% |

For example, this balance of £30,000 earns interest across two different rates. The first £20,000 earns 3.95% interest and the other £10,000 earns 3.85% interest. After 12 months, you would have £31,175.00.

Saving balance of £30k

Your eligible deposits with Yorkshire Building Society are protected up to a total of £85,000 by the Financial Services Compensation Scheme, the UK's deposit guarantee scheme.